2024 Budget | Growing Better Together

Our plan for the future

Niagara is a growing region. To grow better together, the Region makes important investments in programs, services and infrastructure that affect your daily life.

Key investments include water and wastewater infrastructure, public transit, affordable housing, and road and bridge rehabilitation.

To prepare for the 2024 Budget process, Niagara Region reviewed its operations to find efficiencies even though demand for services is increasing.

The result: annual operating costs for Regional departments were set below the rate of inflation.

Regional Council approved the 2024 Budget in December 2023.

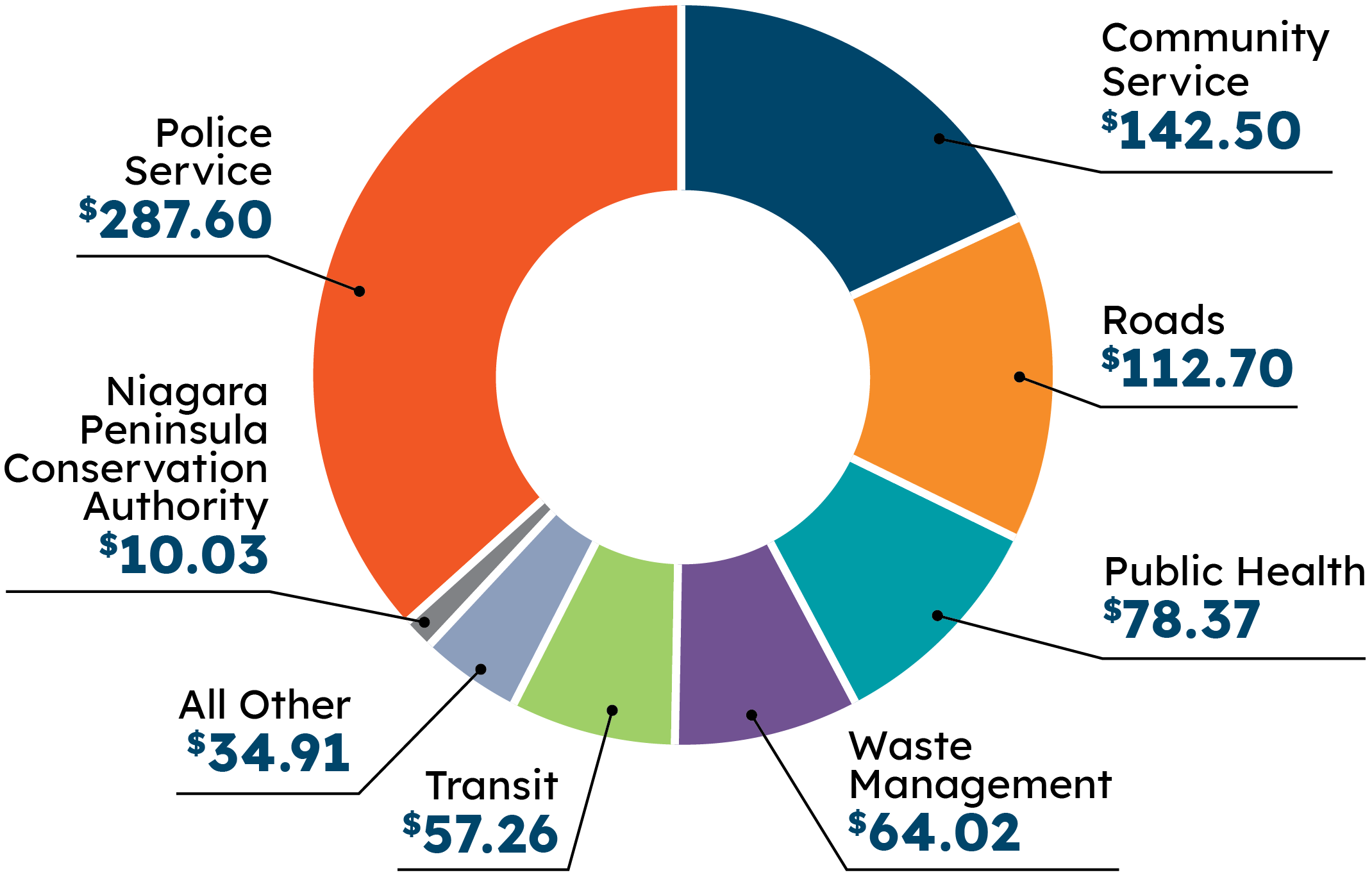

Tax spending for every $100,000 of your home

Budget summary

The 2024 Budget supports our 2023-2026 Council Strategic Priorities: Growing Better Together which serves as a roadmap for Niagara Region over the next three years. In that plan, Regional Council has committed to becoming a more Effective, Green and Resilient, Equitable and Prosperous region. Learn about the 2024 Budget Summary.

Operating budget

The operating budget is funded by four buckets.

General Tax Levy

Collected through the Regional property tax. This rate is charged equally to residents across Niagara.

$483M (7.02 per cent increase)

Transit Special Tax Levy

One of two special tax levies collected through the Regional property tax. Rates vary for each city or town.

$58.4M (6 per cent increase)

Waste Management Special Tax Levy

One of two special tax levies collected through the Regional property tax. Rates vary for each city or town.

$45.2M (0 per cent increase)

Water and Wastewater Rates

Niagara Region bills cities and towns based on usage. The cities or towns determine the charge for each customer.

$154.6M (7.95 per cent increase)

Operating budget expenses

| General tax levy expenses | Percentage increase |

|---|---|

| Niagara Region operations | 2.21% |

| Agencies, boards and commissions, including Niagara Regional Police Service | 2.63% |

| Critical investments in historically underfunded infrastructure renewal across Niagara | 1.5% |

| Support for the financial impacts of provincial policy under Bill 23, which requires municipalities to provide development charge exemptions | 1.8% |

| Operating costs of growth and new programs | 0.54% |

| Assessment growth from new or enhanced properties | (1.66%) |

| Total | 7.02% |

| Special tax levy budget | Percentage increase |

|---|---|

| Waste Management: Curbside collection and disposal of garbage and organics | 0% |

| Niagara Transit Commission: The Niagara Transit special tax levy included one-time charges for benefits related to employees transferred from the municipalities. The levy increase with these amounts is 3.97%. | 6% |

| Water and wastewater expenses | Percentage increase |

|---|---|

| Water and wastewater treatment, such as biosolids management, lab services and infrastructure costs. This included 4.1 per cent or $5.9 million for infrastructure renewal needs. | 7.95% |

Capital budget

The capital budget funds long-term assets like roads, equipment and facilities that are essential to providing services.

In 2024, Niagara Region is investing $270.3 million in Regional assets, with 70 per cent dedicated to renewing existing infrastructure across the region. In addition, incremental investments are being made to enhance affordable and supportive housing options.

Highlights from operating and capital budgets

$8.6M

To replace provincially regulated development charge revenue losses due to Bill 23

$6.7M

To support infrastructure needs for Regional departments and agencies, boards and commissions

$4.1M

To stabilize the homelessness system with shelter outreach and support

$2.2M

To subsidize housing provider operators

$17.2M

To invest in sustaining affordable housing units

$15.8M

To replace 19 new conventional public transit buses

$12M

To resurface roads across Niagara

$13.9M

To build 48+ units of supportive and affordable housing units in phase one on Geneva Street